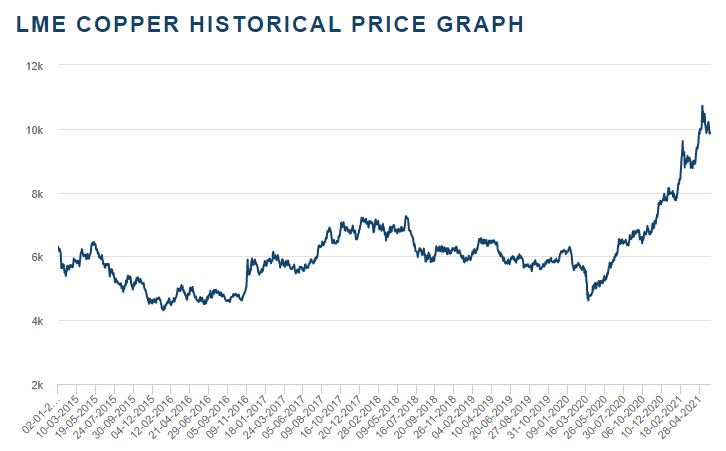

We all know the rise in copper prices has made it difficult for SME to compete with larger corporations. Having received feedback from our clients, we’ve had an extensive look at what the causes are in an attempt to provide them with the latest information.

Supply and Demand

Global demand for copper is approx. 20million tons this year, half of it accounted for by the Chinese market. Since this growth, investors have become optimistic in the Chinese economy and demand and therefore driven prices higher. Whilst this may seem like good news for the Chinese economy, the supply of copper and ore products have decreased. Due to the pandemic and other circumstances Chiles mining output has been interrupted in recent months therefore affecting the supply.

Copper Prices and Stock Market

British economists believe the stock market is volatile and liquidity is volatile. Therefore, investors are opting to choose copper to min the risk. Recently we’ve seen a change in investors, dumping the US stock market during peaks and turning towards other markets. US Stocks with high price-to earnings ratios are still making investors cautious

With the decline in gold releasing financial market risks, a gradual recovery of the economy is reflected in prices of copper/silver. Historical data analysis shows a correlation between copper and oil prices. Similarly classed as a precious metal, copper reached its peak four years ago. In recent years, the price has been in a bear market.

Copper prices and economic Cycles

Copper is favoured as the best economy in the world. Falling or rising copper prices are often used to judge the turning points in economic cycles or the stock market. Since the 90’s, international fund research has found hard copper currency has increase its economic correlation with analysists speculating it’s due to its basic investment in future domestic hedge funds. We’re led to believe as the market rebounds, the price of copper may rise accordingly.

Increment by investors

Data from the US Commodity Future Trading Commission, shows copper options for hedge funds and other funding has increase by about 20% month-on-month. This has led to investor confidence for trading, however it does not rule out the possibility for speculation.

Copper and the oil market

Due to the fall in prices, global factories dealing with copper have reduced or stopped production. In the meantime, mining companies with lower costs continued production and high-cost companies reduced or stopped production altogether.

This reduction supported copper prices. Copper mining as the aforementioned Chile have taken measures to cut cost. Since crude oil has always been closely related to the copper market due to its function of resisting inflation vs international crude oil prices relating to the level of inflation.

To summarise, the rise in copper price may be due to a boost in the demand and decrease in supplies, the recovery of the real economy, rise in stock markets and the correlation between crude oil and copper markets.